Key trends shaping the mining and metals sector in Southern Africa, Part 1

Part 1: Growth and portfolio diversification

As the world works to reduce carbon emissions and mitigate climate change, there’s an increase in the expected demand for resources enabling the energy transition, especially for renewables and energy storage technologies. These resources also include nickel, cobalt, copper, graphite, phosphates, and manganese as positive contributors to the overall commitment to greener, safer solutions.

The diversification of global supply chains is driving the need for mining and metals companies to rethink their portfolios, including consideration of regions within which they have not historically participated. Choices exist across three dimensions: new commodities, new regions, and down-streaming in the value chain. Harmony Gold, traditionally a single-commodity-focused operator, acquired a copper project in Australia. Similarly, Anglo American moved further down the value chain by collaborating with Aurubis AG on copper recycling, while Thungela Resources entered a new region by acquiring an Australian coal mine.

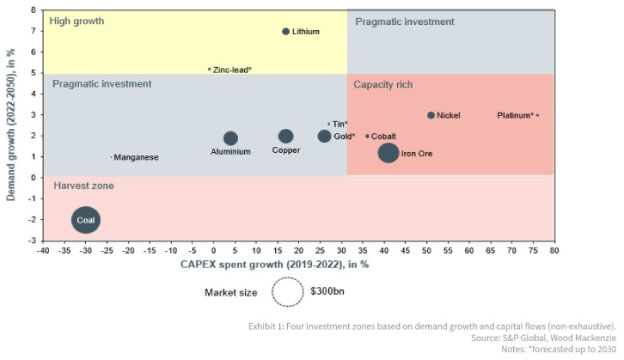

When considering where to invest, organizations need to understand the demand-growth forecast for commodities of interest and overlay this with the flow of capital and assess if the flow matches or exceeds the expected demand growth, or if there are commodities that are under-capitalized.

Platinum and nickel have experienced significant increases in capital between 2019 and 2022, whereas manganese and aluminum experienced low levels of capital by comparison over the same period. Combining the forecasted demand growth rates and historic capital flows, we see four specific groupings of commodities emerge:

- High growth. Commodities with high demand growth forecast that are under-capitalized such as lithium and zinc-lead. Here, investors want to capture prime assets for long-term return.

- Pragmatic investment. Close matching between capital investment and anticipated growth in commodities such as aluminum, copper, and manganese. There are still opportunities for investment, but companies must ensure that investments lie within cost-competitive assets.

- Capacity rich. Commodities with high capital investments compared to demand growth forecasts, such as platinum and nickel. Investors need to exercise caution and revisit existing assets for resilience against lower prices and review new investments.

- Harvest zone. This includes commodities whose long-term demand is in decline. Value needs to be maximized to reinvest in the energy transition in the medium- to long-term.

Four investment zones based on demand growth and capital flows

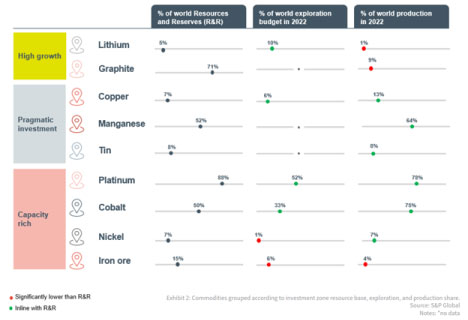

To understand Africa’s opportunities, players are assessing how investment in exploration and production compares to Africa’s share of global resources and reserves. In the high-growth zone, we see proportionately higher exploration spending for lithium, indicating availability of explored assets on the market for acquisition and further investment.

在务实的投资区域,我们看到exploration matching the resources and reserves, coupled with capital investment and increased demand. Focus in this zone should be on gaining interest in existing viable assets or extending existing operations. In the capacity-rich zone, we see lower levels of exploration. Assets in this zone have already progressed to project stages and the market is cautious about oversupply.

For further downstream participation, mining companies must understand the relationship between processing capacity and mining production in Africa. There are two clusters of commodities, with some moderately under capacitated, such as iron ore and nickel, while others are significantly under capacitated, such as cobalt and manganese.

Having considered the factors influencing portfolio composition, we see players consolidating this into a portfolio strategy and roadmap. Six dimensions are considered when configuring the portfolios: location (e.g., local, regional, and continental); value chain (e.g., extraction, processing, refining, first use, and final product); commodity mix (e.g., existing commodities, adjacent commodities with a similar mining method, and transformational commodities); go-to-market (e.g., customized products for green downstream such as green steel and battery manufacturing, in contrast to generic products targeted at metals traders, etc.); investment return profile; and investment scale.

Organizations are making gradual transitions. Sibanye Stillwater, once an operator of limited-life gold assets in South Africa, transitioned to a global portfolio of commodities that are relevant to the energy transition and circular economy. The progressive nature of their journey gave them the capacity to grow geographically and develop global functionality, ultimately enabling the integration of multiple commodities.

There’s a three-step approach to developing and executing a growth and diversification strategy of this magnitude:

- Set strategic direction by assessing where the value is. Assess risk-comfort and review strategic strengths before prioritizing areas of interest.

- Prioritizing potential investments by defining key evaluation criteria, performing asset scans, and shortlisting the best options.

- Developing deal structures, conducting due diligences, and executing deals.

Part 2 of this blog series will discuss how the implementation of digital technologies has created a shift in the way of working and in the reduction of the management gap. Contact Hatch for further information on growth and portfolio diversification and to find out more about how they are shaping the mining and metals sector in Southern Africa.

Khutso Sekgota

Senior Principal, Hatch Advisory

Khutso Sekgota is a Senior Principal in Hatch Advisory. He supports senior executives in mining, infrastructure, and energy as they set strategy and undertake business transformation programs to pursue growth, improve operational performance, optimize supply chains, and collaborate with stakeholders. He has 15 years’ experience across tier 1 global management consulting firms, having commenced the first 6 years of his career in manufacturing, driving continuous improvement and maintenance management.

Herman Strauss

Principal, Hatch Advisory

Herman Strauss is a Principal in the Advisory practice at Hatch where he supports clients across strategy and planning, deal advisory and implementation, as well as excellence in operations. He started his career at Hatch as a project engineer before joining a global management consultancy where he served mining and energy clients in South Africa, Indonesia, and Singapore. Herman has served clients across areas including strategy, technology enabled operations, restructuring, decarbonization and next zero strategies.