The EU Green Deal in Light of the IRA and the Geopolitical Landscape

Tackling climate change began being addressed worldwide in the 1990s. Since then, the European Union (EU) has taken on a leadership role and become a pioneer in implementing climate policies, such as the Emissions Trading Scheme that has helped reduce greenhouse gas (GHG) emissions by over a quarter from the 1990 levels [1]. In late 2019, the EU introduced the Green Deal, an array of policy initiatives designed to move Europe closer to becoming the world’s first climate-neutral continent by 2050. As part of reaching this goal, the European Commission (EC) pledged to reduce EU countries’ GHG emissions by at least 55% by 2030. [2].

The Green Deal includes the revision of various European directives and regulations (e.g., Renewable Energy Directive, TEN-E Regulation, etc.). To achieve its ambitious targets, the Green Deal Investment Plan proposes €1 trillion in financing over ten years [3].

While the EU was a reference in climate action from the beginning, the United States (US) has had varying approaches over the years. Initially focused on voluntary action, the US started to shift toward a federal regulation in the 2000s, but only showed real commitment after signing the Paris Agreement in 2015. Two significant occurrences followed: The US withdrawal from the Paris Agreement in 2016 and its reintegration in 2021. In August 2022, the US Inflation Reduction Act (IRA) was signed into legislation by President Biden. With growing pressures to achieve a 50% reduction in GHG emissions by 2030 (relative to 2005), the IRA aims to foster a clean energy economy through various pathways across industries. These pathways include corporate and consumer incentives, grants, and loans spread across the energy, manufacturing, environment, transportation (including electric vehicles), agriculture, and water sectors [4].

With approximately USD $370 billion estimated to be distributed over ten (10) years through the IRA incentives, the US seeks to stimulate its domestic manufacturing capabilities, promote procurement of key equipment either from domestic sources or free-trade partners, and motivate the development – from R&D through commercialization – of next generation clean energy and emission reduction technologies [5]. Furthermore, the IRA established clear policies through a simplified scheme of incentive programs in different formats. Figure 1 below indicates how the USD $370 billion figure will be spread between different forms of incentives.

Producing such a graph for the Green Deal would be a nearly impossible task, given the complexity of programs under its umbrella and the lack of clarity on how some announced programs will achieve their target.

A few months after the IRA was signed, significant results could already be observed. There was massive excitement from the renewable energy industry concerning direct investments to the US. Private companies announced at least $64 billion in new investments into more than 130 new clean energy projects expected to create more than 53,000 new jobs [6, 7].

There were also numerous external reactions to the IRA. The EU immediately responded by creating a commission to discuss the impacts of the IRA on its economy and to persuade the US to back down on specific protectionist measures that promoted a “Buy American” philosophy. Whether that proves to be effective is difficult to predict, but there’s no doubt that the IRA has shaken the EU’s positioning and raised the question about how the bloc will respond.

Expectations are the US will continue to grow its green industry, at least for the remainder of Biden’s mandate, and likely until the tax credits expire in 10 years. This ensures the US will continue to impact climate change and the global economy in the coming years. Other major economic powers will need to produce calculated responses to account for those impacts as they relate to the US and its IRA program, which are briefly summarized in Table 1.

Strengths |

Weaknesses |

|---|---|

|

|

Opportunities |

Threats |

|

|

Despite the favorable status quo in the race for a leading green economy, Europe currently faces the threat of a post-IRA United States. At the same time, an energy crisis created mostly by the Russian war with Ukraine and Europe’s dependency on Russian natural gas is shifting the US status toward the EU from partner to powerful supplier, particularly in the energy sector [8].

The EU member states have the tools to even the balance but haven’t been able to fully put them into practice just yet. The Green Deal was created when President Trump was in the White House, which was well before the IRA was even considered. However, the lack of unity in decision-making among the member states, the characteristics of the program, and the muti-jurisdictional regulations have hindered its appeal to the industry. Though a range of decentralized policies were adopted, they lack the game-changing extent of the IRA.

The time for a European response is due, and it has started to be drafted by the launch of the Green Deal Industrial Plan, which promises a simpler regulatory framework and repurposes the Temporary State Aid Crisis Framework for member states to accelerate access to funds and manufacturing for strategic renewable energy and decarbonization projects [9].

In summary, the Green Deal is a robust program that will require some adjustments to make EU more attractive for companies to move toward the new green economy in the coming decades. Below, Table 2 highlights some of the essential features of the Green Deal program.

Strengths |

Weaknesses |

|---|---|

|

|

Opportunities |

Threats |

|

|

Path forward in Europe

Both the EU Green Deal and the IRA focus on achieving target carbon emission reductions but also on increasing the competitiveness of their industries [10]. In that sense, the IRA has shown to be more attractive to industry players by promoting incentives on the supply side with tax credits while – until the recent launch of the Green Deal Industrial Plan – the EU has focused on subsidies to stimulate demand, with indirect incentives to the industry only. These incentives were more focused on reduced price instead of the reduced cost of production [11].

The EU must focus on strengthening its self-reliance and technological aptitude and adapt its policies to consolidate its initiatives toward climate change. Furthermore, with the IRA established on the other side of the Atlantic, new challenges arise as a result of the competition for both resources and market share, protectionist measures, and the instability caused by the Russia-Ukraine conflict in the continent’s economy and energy matrix.

In this scenario, Europe can revisit its program on some key strategic pieces, without compromising the Green Deal’s fundamental objectives and aspired achievements. These suggested actions, listed as a path forward for Europe, are based on either one or a combination of three targets:

- 加速欧洲的绿色能源过渡华体会体育彩票

- Reduce dependency on foreign countries

- Achieve a higher degree of domestic industrialization

Focus on hydrogen – selected discussion topic

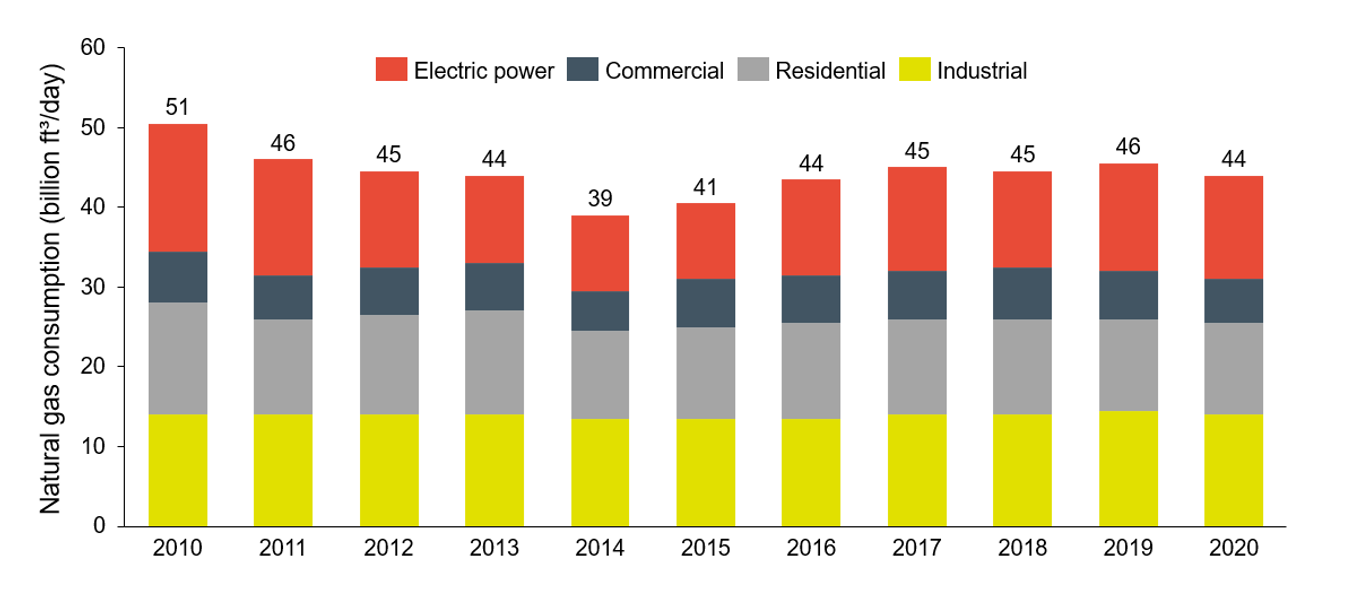

Even with a shift toward producing green electricity, Europe still depends on the direct use of natural gas for many applications, including household heating and industrial use, as shown in Figure 2.

Development of infrastructure to enable substitution of natural gas by green hydrogen will be essential in reducing the EU’s dependency on imports. Such initiatives will be subsidized by European governments to help accelerate the switch. Currently, the bloc plans to subsidize projects through a premium per hydrogen produced. Auctions will be held to award a fixed premium to hydrogen producers per kilogram of hydrogen for up to 10 years. The first auction in 2023 would offer around 800 million euros in incentives. Additionally, funds are available via programs such as the Connecting Europe Facility (CEF) and Innovation Fund that could amount to 50% of new hydrogen projects’ CAPEX.

The IRA has a simple tax credit scheme, with defined values already per kg of H2. The credits vary according to the carbon intensity required to produce hydrogen, but there is a maximum of USD $3/kg of hydrogen.

A similar impact is expected with both policies – the lack of a pre-defined premium value in the EU plan represents how complex it is for companies to know exactly what they can get as incentives, not only for hydrogen production but from the entire umbrella under the Green Deal. Splitting the premium benefit into several auctions will cause some variability in the market. That may hinder the participation of smaller producers, leading to higher incentives in the first auctions when competition is fierce.

On the other hand, compared to tax credits, it’s a simpler incentive to pay out and control. When combined with the support on capital expenditure, producing hydrogen can become much more attractive to the industry in Europe in the near future, if latest Green Deal plans can finally turn into reality.

Interstate connectivity – selected discussion topic

The net-zero race, when not well-planned, can lead to increased gaps between rich and poor states, or between polluting and non-polluting states. When looking at the EU bloc or the US as a federation, there is a need for internal connectivity, to ensure green energy is well distributed in all its forms. Furthermore, within these initiatives, connection to offshore wind farms will be necessary to enable exploring the potential of this energy source. Investments in new infrastructure are required and are also part of a scheme of fundings and incentives within the IRA and the Green Deal. As a massive example, recently announced LionLink will connect up to two gigawatts of offshore wind between the British and Dutch electricity systems and will be the largest project of its kind so far, to be operational in early 2030s [13]. The US has established three programs within the IRA that cover infrastructure for interstate connectivity. For offshore wind, there is $100 million available for planning, modeling, analysis, and development of interregional transmission in funding. A part of the $9.7 billion to the Department of Agriculture (USDA) includes improvements to electric generation and transmission systems, including loans. And finally, $760 million in the form of grants has been allotted through 2026 to facilitate the siting of interstate electricity transmission Lines.

In the EU, the Trans-European Networks for Energy (TEN-E) is the regulating program for development of interstate and offshore grid. The program has already established a number of corridors that will be considered for development. Once again, the total amount of funds that will be directed to these grid corridors is less clear than in the IRA, but if projects are within these corridors, it’s likely that the incentives will be easily obtained. Examples of current projects being funded under these programs include:

ELMED interconnector, which received €307.6 million for an electricity transmission project that will support the construction of the first interconnection between Italy and Tunisia using an undersea high-voltage direct current electricity cable.

GreenSwitch, which is a cross-border electricity smart grid project between Austria, Croatia, and Slovenia that received €73.1 million in funding for investments.

The incentives in interstate connectivity are generally less focused directly on the private sector of the industry. However, private companies will also benefit by partnering with public agencies to develop this infrastructure.

Conclusions

Overall, both the EU Green Deal and the IRA are very comprehensive programs, covering a wide range of sustainable initiatives, and with a great potential for achieving their targets to cut carbon emissions and foster domestic manufacturing base development within their regions. From the European perspective, the main differences between the two are based on the IRA offering tax credits and promoting supply rather than demand, the relatively less complex nature of the IRA (which can save months or years of bureaucracy and attract business faster), and the IRA’s protectionism aspect. The latter, although targeted at China, impacts European countries as there is concern about the lack of access for EU companies to the US market and a potential industrial exodus to the North American competitor. This concern increased as the dependency on natural gas supply shifts from Russia to the US and other countries, further jeopardizing the commercial balance equilibrium between Europe and the US.

The IRA has raised concerns among European countries due to its protectionist features. That said, Europe should respond by focusing on a few specific changes to the EU internal regulations without compromising its supply chain of much-needed critical resources from other countries. These changes should include simplifying EU’s red tapes at the bloc and member states levels, streamlining access to funds, reducing implementation complexity and timeframe, and promoting tax incentive regulations to some extent.

How will different players in the value chain benefit from, and be challenged, by the EU Green Deal?

Companies operating in the power value chain will have to continue adapting to a dynamic political scenario. There will be many opportunities for companies that are able to understand that the future in Europe is with renewable energy. The Green Deal will heavily finance demand and promises to stimulate supply with fundings and premiums.

On the other hand, taxes will remain a significant burden in the long term, unless there is a change in the EU’s approach to tax incentives and credits. Also, due to increased capital costs in Europe, companies will have to cope with a potential longer return on investment, although costs could be transferred to consumers and the government under the incentives scheme.

Competition with the US is perceived as a threat to the EU and will likely lead to a small-scale protectionist response from the member states. In the long run, players in Europe will also be expected to compete with and/or replace Chinese products. Companies that wish to thrive in the European market must be prepared to build their local supply chains, produce in the continent, and leverage their presence as a competitive advantage.

How Hatch can help in achieving the EU Green Deal goals

Hatch is very active in the energy transition worldwide and engaged in conceiving and implementing hybrid power projects. From renewables, batteries, microgrid controls in remote industrial sites and communities and at grid scale, to renewables with green hydrogen production and long-term energy storage. We work on first-of-a-kind (FOAK) projects, continuously learning and advancing our knowledge from one project to another.

We are passionately committed to the pursuit of deploying emerging energy transition technologies (energy storage systems, electrolyzer, and new wind and solar technology); we simulate, optimize, and conceive some of the best projects to decarbonize the industry. We attain real carbon-reduction results by supporting our clients with strategic planning, mergers and acquisitions, and engineering energy transition projects to commissioning.

References

- EU agrees to COP27 compromise to keep Paris Agreement alive (europa.eu)

- A European Green Deal (europa.eu), European Green Deal Policy Guide - KPMG Global

- The EU Green Deal explained | Canada | Global law firm | Norton Rose Fulbright

- The-inflation-reduction-act-heres-whats-in-it_final.pdf (mckinsey.com)

- Inflation-Reduction-Act-Guidebook.pdf (whitehouse.gov)

- Six months in, the Inflation Reduction Act is already unleashing clean energy’s potential | The Hill

- How the Inflation Reduction Act is impacting green job creation | World Economic Forum (weforum.org)

- Impact of Russia's invasion of Ukraine on the markets: EU response - Consilium (europa.eu)

- https://ec.europa.eu/commission/presscorner/detail/en/ip_23_513

- IRA vs RepowerEU: the great divergence | Library (natixis.com)

- ‘We like the IRA’: European firms lured by simplicity of US green subsidies – EURACTIV.com

- U.S. Energy Information Administration - EIA - Independent Statistics and Analysis

- 国家电网和TenneT协作提出了first-of-a-kind Anglo-Dutch electricity link | National Grid Group

About Hatch

无论我们的客户想象,我们的团队可以设计n and build. With decades of business and technical experience in the energy, mining, and infrastructure sectors, we know your business and understand that your challenges are changing rapidly. We respond quickly with solutions that are smarter, more efficient and innovative. We draw upon our 10,000 staff with experience in over 150 countries to challenge the status quo and create positive change for our clients, our employees, and the communities we serve.

Find out more on www.blogandtalk.com