Risk management

Facilitating risk-based decisions for more predictable business and investment outcomes

Read our blogs on risk management

Navigating the complexities of designing and constructing a gigafactory.

Towards the resilient storage of tailings

Imagine a future world without the raw materials necessary to make much of the resources and tools we depend on.

Related projects

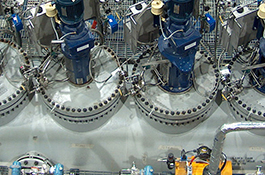

Li-Cycle Rochester Hub

Rochester, New York, USA

Organizational design and right-sizing

North America

Westside Modernization Project

Saint John, New Brunswick, Canada

hth官方网址

Asia

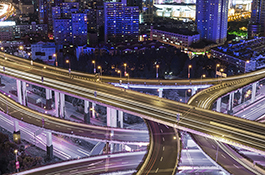

Kingston Third Crossing (Waaban Crossing)

Kingston, Ontario, Canada

Three Chain Road project

Australia

bob华体会

British Columbia, Canada

Sulfuric Acid Plant

Democratic Republic of the Congo (DRC)

Related Services and Technologies

Project Controls

Project Management

Capital productivity

水

城市解决方案

Tunnels

Transportation & Logistics

Transit

Thermal Power

Renewable Power

Rail

Transmission & Distribution

Ports & Terminals

Nuclear

Mining

Modern Mining

Innovation in Mining

Hydrometallurgy

Highways & Bridges

Engineering

Responding to the energy transformation

Sustainable Urban Development

Construction Management

Commissioning

Comminution

Aviation

Custom evaporation and crystallization solutions

Operations readiness, commissioning, and ramp-up

Hydropower & Dams